Every day, there are thousands of discussions in businesses that rely on data for answers. Many of these conversations fall into the same patterns where the data is unique, but the questions and goals are the same.

- How well is our ad campaign delivering?

- What's the ROI for that capital project?

- Who are my top performing sales people?

At Juice, we’re interested in finding the common situations where people use data as the centerpoint of a discussion. Then we build tools to make those conversations more productive.

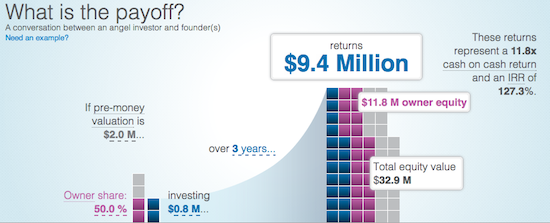

One interesting conversation for us is the one that occurs between start-up founders and investors. Due to the sensitivity involved, its extra important that both sides have a shared view of company valuation and projections. After seeing this conversation play out with spreadsheets and PowerPoint slides, we thought it could be a lot more productive if there was a simple, interactive tool to explore scenarios.

If you're thinking about taking investment or talking to investors, our company valuation tool let’s you to test different assumptions and the see the financial results. Here’s how it works:

1. Set pre-investment assumptions. Input how much the company is worth before an investment and how much investment you are looking for.

2. Add assumptions about revenue and/or profit growth. Choose the number of years for your projection, then drag the trend lines to reflect your model for growth.

3. Choose valuation model. Do you want to set a valuation based on revenues or EBITDA? You'll need to adjust the appropriate multiple.

As an extra bonus, we have a feature to see what the valuation scenario means for the current owners of the company. Turn the owner valuation toggle to "on" in the upper right corner.

We also have a short video of the tool in action.

There you have it: a simple tool for considering company valuation scenarios. We’ll be the first to admit that the valuation model is relatively straightforward. There is no support for liquidation preference, complex pre-investment financing structures, option pools, or how to repay your mom's loan. Nevertheless, we hope it serves as a productive starting point for discussions with investors.

This was developed using Bret Victor's Tangle JS library and D3.js for the visualization.